About Endowment Funds

An endowment fund is a sum of money invested to generate income, providing long-term financial stability for a nonprofit organization while offering donors the assurance that their contributions will have lasting impact and sustainability.

You can turn an inheritance or a cash gift into an endowment fund to support the CBF ministries and missions that are important to you. An endowment fund is also a great way to honor or memorialize an important individual in your life. CBF Foundation can help you set up an endowment fund that matches your passion.

Benefits

- Create a stable, ongoing source of income to support CBF mission and ministry causes in perpetuity

- Receive an immediate income tax deduction for the value of your contributions

How it works

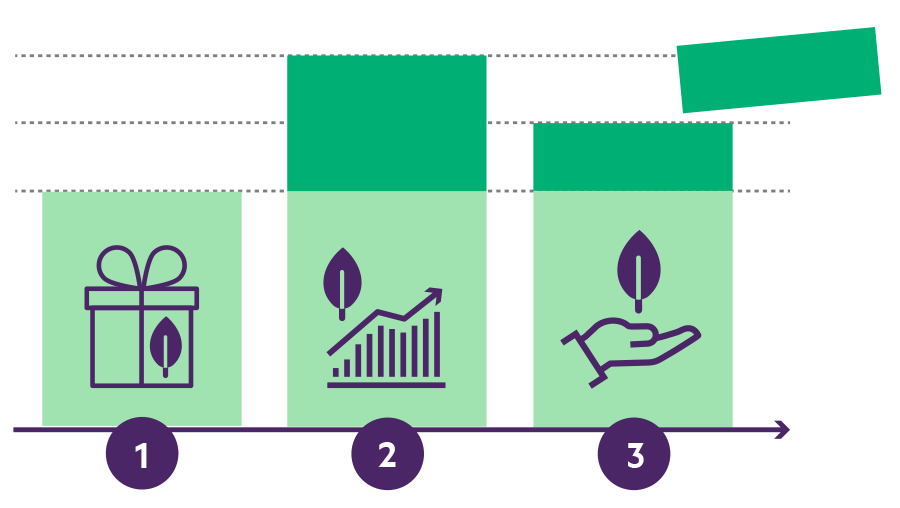

- You make a gift to establish the fund. That gift may come in many forms: cash, appreciated stock, real estate, life insurance, or some other asset, or you may convert a donor advised fund to a permanent endowment.

- The money used to create an endowment, referred to as principal, is prudently and strategically invested for long-term growth and income.

- Your permanent endowment will make annual distributions to support the CBF ministry or causes you’ve identified. For example, you could fund CBF general operations, Global Missions, scholarships for young Baptists, racial equity and justice work, rural poverty, advocacy, chaplaincy, etc. You decide.

Most endowments have a predetermined annual payout rate, which is calculated as a percentage of the value of the principal. A general rule is that an endowment can provide an amount of annual income equal to 4%-5% of its principal value.

Learn more about Endowment Funds

Consult with a qualified estate planning attorney and a financial advisor to determine if this option is right for you.

We’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Name: Shauw Chin Capps

Title :Foundation President & Chief Development Officer

Phone: 770-220-1622

Email: scapps@cbf.net

Already included us in your estate plan? Let us know

More ways to make an impact

Gifts in a will or trust

Donations in your will or trust are (by far) the most popular type of planned gift. Learn more, or get help starting your will (for free!).

Beneficiary designations

Gifting assets not covered by your will — like 401(k) or IRA accounts — may help your heirs avoid unwanted taxes, even if you’re below the estate tax threshold.

Popular tax-smart gifts

Many people are increasingly choosing to give non-cash assets, so they can have a bigger impact at less cost to them.